Ally Bank and Zelle have been at the forefront of revolutionizing the way we handle money. Their collaboration has brought about a significant shift in the financial industry, making transactions more seamless and efficient.

This partnership has not only benefited the institutions but has also provided consumers with a more streamlined banking experience.

Evolution of the Collaboration

The partnership between Ally Bank and Zelle didn’t happen overnight. Both entities made a strategic decision to enhance the banking experience for their customers.

Over the years, they’ve achieved several milestones that have solidified their position in the industry. From introducing faster transaction speeds to ensuring top-notch security, their collaboration has been nothing short of groundbreaking.

| Year | Milestone |

| 2018 | Introduction of Zelle in Ally Bank’s platform. |

| 2019 | Achieved 1 million transactions in a month. |

| 2021 | Introduction of biometric security features. |

| 2023 | Launch of a new user interface with enhanced features for better user experience. |

Features & Benefits

2023 has been a promising year for Ally Bank and Zelle users. The enhanced transaction speeds mean that you no longer have to wait for hours or even days for your transactions to process. This is especially handy for those last-minute bill payments or urgent transfers.

Moreover, the security measures have been ramped up. With the increasing threats in the digital world, both Ally Bank and Zelle have taken proactive steps to ensure that every transaction is secure and that users’ data is protected.

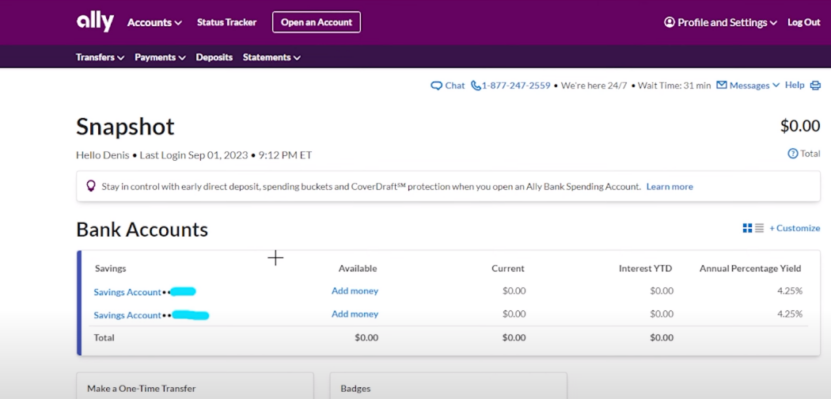

Another notable update is the user-friendly interface. Banking can be complicated, but with the new interface updates, navigating through your transactions and other banking needs has become a breeze.

Setting Up Zelle with Ally Bank

First, you’ll need to have an Ally Bank Spending Account. One of the perks of this account is that there are no monthly fees, and there’s no minimum deposit required to open it. Once you have your account set up, you can easily link it with Zelle.

To fund your Ally Bank account, you can set up a direct deposit of your paychecks. Additionally, Ally’s eCheck Deposit feature allows you to deposit paper checks using your cellphone camera. And yes, Ally fully supports Zelle, the peer-to-peer payment platform that lets you send or receive money from friends and family.

| Feature | Description |

| Spending Account | No monthly fees, no minimum deposit, supports Zelle transactions. |

| Savings Account APY | Offers an impressive APY of 4.25%. |

| ATM Network | Over 43,000+ Allpoint ATMs with up to $10 reimbursement for out-of-network. |

Transaction Limits

When it comes to transaction limits, Ally Bank has set certain standards to ensure the safety and security of its users. For the Ally Bank Spending Account, if you use an Allpoint ATM, you won’t face any charges. However, if you go outside of that ATM network, which boasts over 43,000+ ATMs, Ally will reimburse you up to $10 per statement cycle.

Furthermore, Ally Bank pays an APY of 0.10% on checking accounts with less than a $15,000 minimum daily balance, and 0.25% APY for accounts with minimum daily balances of $15,000 or more.

Safety Protocols

Safety is paramount for both Ally Bank and Zelle. With the increasing number of digital threats, they’ve amped up their security measures. Ally Bank ensures that every transaction is secure, and users’ data is protected. They have also incorporated biometric security features to enhance the safety of transactions.

Zelle, on the other hand, has its own set of security protocols. Being a peer-to-peer payment platform, it ensures that the transactions are encrypted and that the users’ data remains confidential.

Potential Challenges & Solutions

While the partnership between Ally Bank and Zelle has been largely successful, users might occasionally face challenges. One common issue is a delay in receiving Zelle payments. If you’re expecting a payment and don’t see it, it’s essential to check if the sender used the correct email address or mobile number linked to your Ally Bank account.

Another challenge could be accessing Zelle due to technical glitches. In such cases, it’s always a good idea to reach out to Ally Bank’s customer support for assistance.

FAQ

Why is there a hold on my Zelle® payment?

Holds on Zelle payments can occur for various reasons. It could be due to security checks, discrepancies in the transaction details, or issues with the recipient’s bank. If you experience a hold, it’s best to contact Ally Bank’s customer support for clarification and resolution.

I sent money with Zelle®, and my recipient hasn’t received the payment. What should I do?

Firstly, ensure that you’ve sent the payment to the correct email address or mobile number linked to the recipient’s Ally Bank account. If the details are correct and the payment hasn’t been received within a reasonable timeframe, reach out to Ally Bank’s customer support for assistance.

How do I change my primary Zelle® email address?

To change your primary Zelle email address, you’ll need to access your Ally Bank account settings. From there, navigate to the Zelle section and follow the prompts to update your email address. Ensure that the new email address is one you actively use and have access to.

Is Zelle® secure?

Absolutely! Zelle, in collaboration with Ally Bank, has implemented robust security measures to ensure the safety of transactions. This includes encryption protocols and other security checks to protect users’ data and funds.

Conclusion

The collaboration between Ally Bank and Zelle has undeniably transformed the digital banking landscape. From enhanced transaction speeds to top-tier security measures, users have been at the receiving end of numerous benefits.

As we move forward, it’s exciting to think about the innovations and updates that await. For anyone yet to leverage the advantages of this partnership, now is a great time to start!